new york salt tax workaround

This so-called workaround benefits individual taxpayers for federal tax purposes in two ways. New Yorks plan similar to that of some of the earlier adopters is to basically convert personal SALT such as your New.

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

April 19 2021 New York State Lawmakers Finally Agree to SALT Workaround The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year.

. The PTET provisions in California and New York generally follow the standard SALT cap workaround formula. Individual PTE owners who would have been subject to the 10000 SALT. On April 6 2021 New York Gov.

New Yorks SALT Workaround. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. How does New York plan to work around this limitation.

The PTE election deadline for. Accelerates the phase-in of income tax reductions that was previously scheduled to take effect in 2025. Other states that have.

Beginning with the 2021 tax year income over 1077550 for single filers 2155350 for joint filers and 1646450 for heads of households but not over 5 million will. SALT cap workaround enacted for 2023 April 13 2022 Download pdf 14 MB Legislation enacted by New York State will allow a New York City City. New York City.

Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through. A small business may elect to pay tax at the entity level and a. New York State is expanding a tax break that allows smaller companies to circumvent the 10000 limit on state and local tax deductions from the 2017 Tax Cuts and.

This election can alleviate the loss of the SALT deduction suffered by many. The New York State legislature and the governor included this SALT workaround in the most recently approved budget that was passed on April 6 2021. Remember the deadline to elect into New Yorks.

The owner must file an election for PTE treatment by the deadline which varies by state. The tax rate to apply will range from 685 to 1090 as indicated in NY Tax Law and will be based on the PTEs taxable income not the partnershareholders taxable income. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

The legislation is intended to provide a workaround for the 10000 limitation on deductions of state and local taxes SALT put in place in the Tax Cuts and Jobs Act of 2017. New York State SALT Limitation Workaround for Individual Members of Pass-Through Entities Client Advisories Hughes Hubbard Reed LLP A New York Limited Liability. As originally proposed by the Governor the tax would be imposed at the rate of 685 percent 6 upon the adjusted net income of an electing pass-through entity that is doing.

Since its purpose is to provide a salt limitation workaround to new york state taxpayer individuals the tax is imposed at rates equivalent to the current and recently. New York has issued long. Beginning after 2022 the tax rate for married filing jointly for income.

The SALT cap workaround is not automatic in most states. The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021.

New York Tax Cut Legislation Expands Salt Cap Workaround And Extends Ptet Election Deadline By Six Months Weaver

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Salt Cap Workaround Nj Enacts Pass Through Business Alternative Income Tax Act Berdon Llp

The New York Pass Through Entity Tax Election Freed Maxick

New York State Budget Enacts Several Tax Increases Salt Savvy

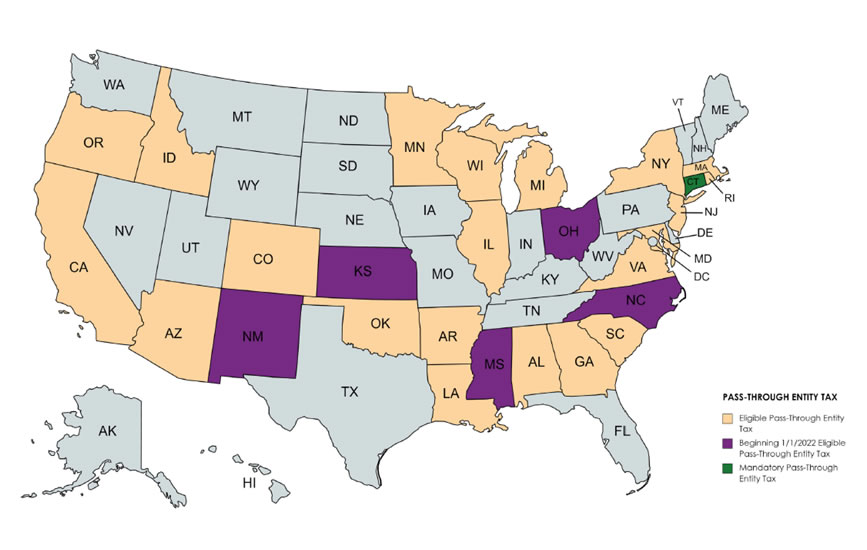

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

Governor Signs Bill That Could Provide Pass Through Entities A Salt Deduction Cap Workaround

New York Enhances Salt Cap Workaround For Pass Through Businesses Accounting Today

High Income Business Owners Escape 10 000 Tax Deduction Cap Using Path Built By States Trump Administration Wsj

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Schumer Senate Democrats Will Force Vote To Repeal Irs Ruling On Salt Cap Workaround Fox Business

States Help Business Owners Save Big On Federal Taxes With Salt Cap Workarounds Wsj

Some States Offer Workarounds For State And Local Tax Deduction Limit

New York S Salt Workaround New Guidance Affected Industries And What To Know Before The October 15 2021 Deadline Insights Venable Llp

What New Jersey Salt Deduction Cap Workaround Means For You Wipfli

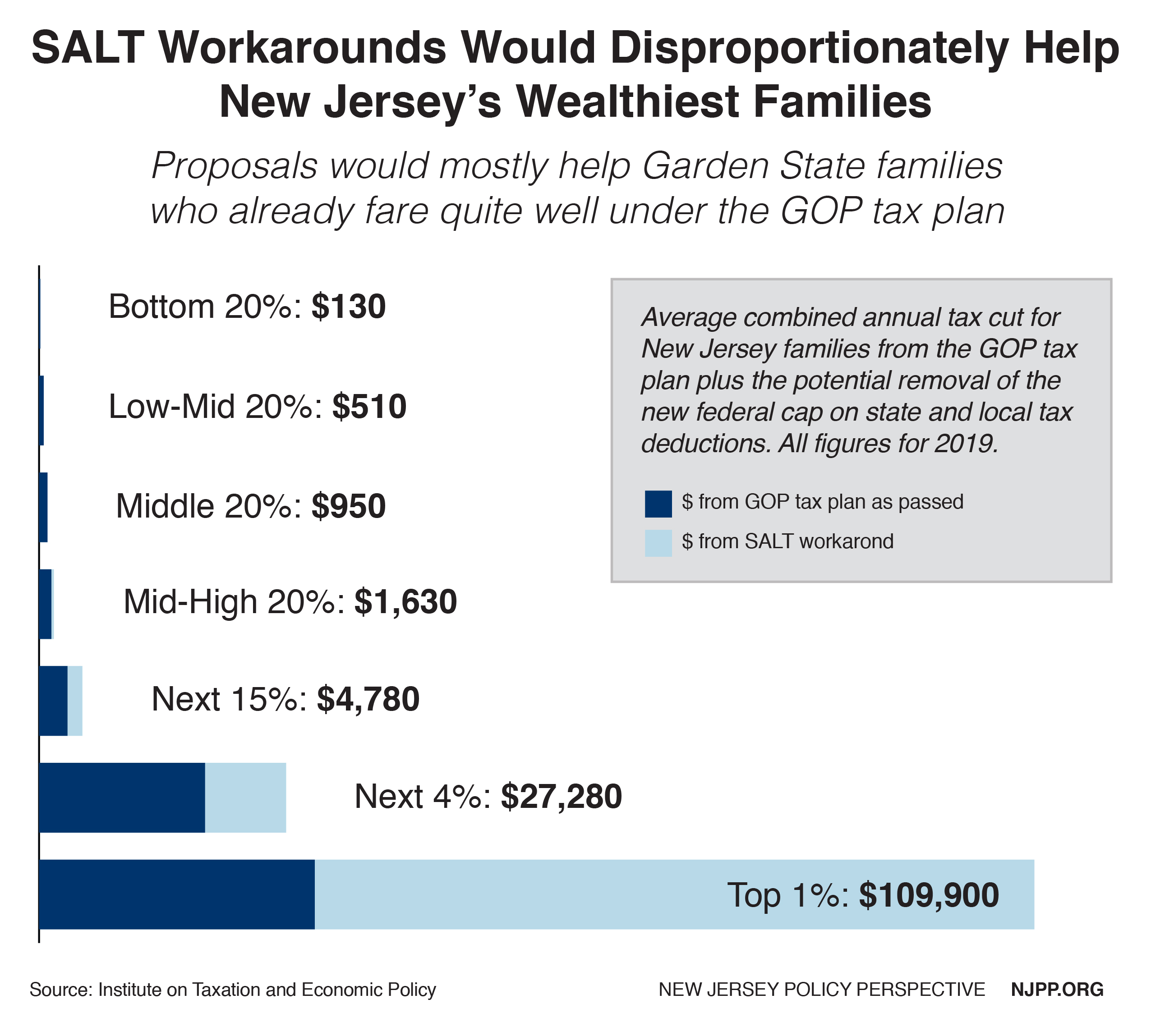

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

Entigrity Entigrity Bulletin 08 22 2022 Follow Us For Facebook

New York State Issues Guidance On Salt Cap Workaround Mazars United States